In a market whose only constant is change, a problem-solving technique identified many years ago seems particularly useful. That technique is the “Five Whys” and it’s a way to get at the root cause of something. Applying it isn’t hard; you literally keep asking “why” until you arrive at what’s really creating whatever the situation may be. The goal of asking why five times reminds us that problems (and opportunities) have layers and if we don’t understand all of them, we risk solving for the wrong thing.

That’s how it is with implementation approaches to AI in account-based marketing (ABM). Right now, we have incredible opportunity to apply technology to solve for challenges we couldn’t before. With that comes the risk that we’ll solve for old challenges but miss the chance for transformative impact. As Albert Einstein said more elegantly, “No problem can be solved from the same level of consciousness that created it.” We need to unpack and address opportunities for change and improvement and be sure we haven’t made false assumptions about what’s needed or possible.

That’s where the findings from Inflexion Group’s 2025 AI in ABM Benchmarking Study can help. While we’re defining what’s possible with AI in ABM, our research shows companies are building what’s useful now and keeping an eye on what’s next.

Why do companies use AI for ABM?

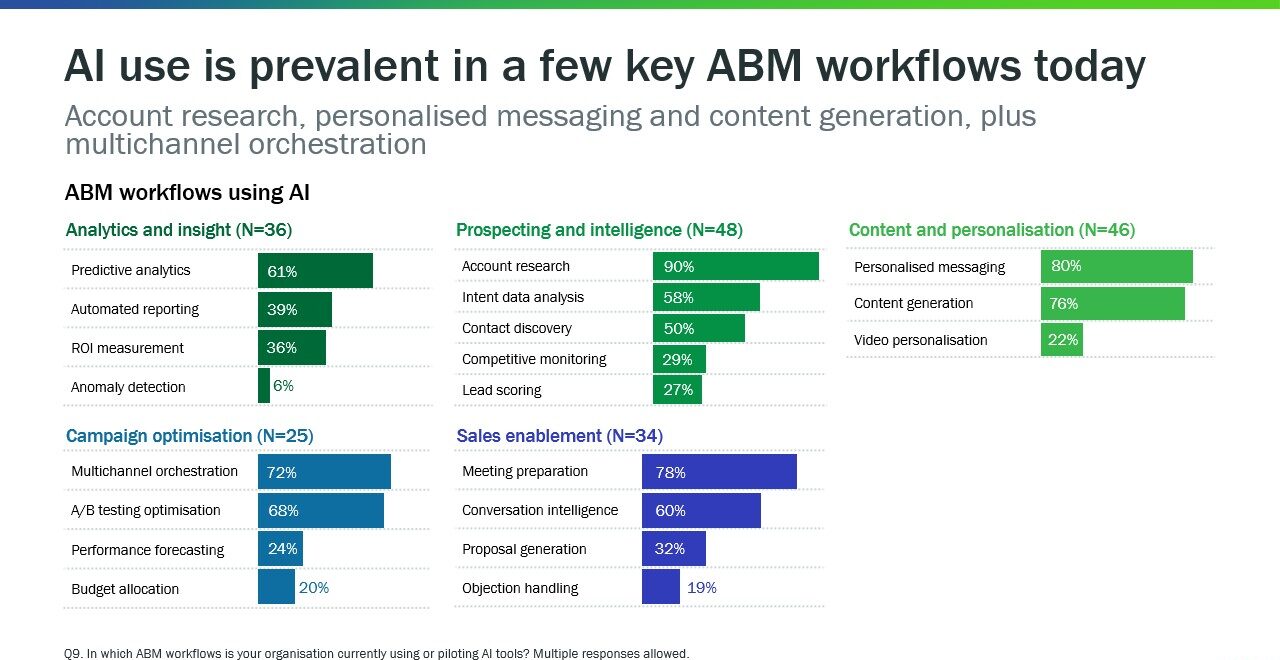

Let’s begin with our first “why,” which is why companies are using AI for ABM. Our study asked respondents which ABM workflows currently use AI, and a few categories stood out as the early reasons for investing.

ABM workflows benefitting from AI today

Source: 2025 Inflexion Group AI in ABM Benchmark Study

Source: 2025 Inflexion Group AI in ABM Benchmark Study

In terms of workflow categories, the largest proportion of our respondents are deploying or piloting AI for prospecting and intelligence (73% of respondents apply it for this) and content and personalization (70%). Next are analytics and insight (55%) and sales enablement (52%), followed by campaign optimization (38%). This maps to the early benefits ABM teams are seeing, which today are primarily from productivity improvements (see more on early ROI from AI in this post). The first “why” points us to a need for ABM teams to make their work faster and easier.

Why are these workflows the early focus of AI deployment in ABM?

For the second “why” question in our series of five, it makes sense to ask why companies might choose particular workflows within the categories. We want to know answer what about specific workflows is ideally suited to seeing immediate benefits in reduced effort and faster output.

When we look inside each category at the specific workflows gaining AI focus, the data suggests we’re looking to AI to do the parts of ABM that tend to take the most manual work and slow down overall program delivery. For example, in the top category of prospecting and intelligence, 90% are using AI for account research, and nearly 60% are using it for intent data analysis. Half are using it for contact discovery. These three areas are essential preparation for ABM success but are also activities teams struggle to do quickly and at scale. AI makes it easier to deliver higher volume, quality output faster, without tying up team members and delaying downstream program execution.

The category of content and personalization shows a similar pattern. Fully 80% are using AI for content personalization and 76% for content generation. Again, both are necessary workflows that were hard to deliver for a high volume of accounts but are perfectly suited to AI’s capabilities. Same with sales enablement, where 78% use AI for meeting prep, and 60% for conversational intelligence. AI lets us instantly unlock information that was previously only accessible via complex and time-consuming analysis.

Our benchmark study also found that teams appreciate both the personal and business impact of these implementations. In addition to the quantitative survey, we did a series of in-depth interviews as part of the benchmark research. ABM-ers shared a few reasons why these applications are so helpful.

Use case examples from companies implementing AI in ABM

Source: 2025 Inflexion Group AI in ABM Benchmark Study

On the impact of applying AI for insights, one respondent said, “it [AI] can save a lot of time, as opposed to hours of doing desk research.” Another noted, “Certainly, the six weeks part of doing all the research has probably netted down to 15 minutes now.”

In terms of content production and personalization, similar benefits are seen: “There’s no such thing as writer’s block anymore, because if you’ve got the ideas, you just throw them

all in.” Another noted, “We have tools that help us draft emails that are perfect. Really, really close to perfect.”

Why does this sound almost too good to be true?

We’ll apply our third “why” a bit differently, this time to challenge the responses to the first and second whys. As the American journalist and writer H. L. Mencken said, “For every complex problem there is an answer that is clear, simple, and wrong.” The easy benefit of AI doing time-consuming tasks in an instant, and at scale, seems like it must have a catch. Is it really as simple as automating and scaling workflows, or could we be looking for more?

Our benchmark data and comments suggest that catch comes in the forms of quality and imagination. When companies apply AI to quick and accessible wins like research and content production, we risk arriving at a new kind of parity. What used to differentiate careful, thorough ABM programs is now table-stakes and achievable by every team. We need to look harder and find what others are not (yet) doing.

Our benchmark data points us in a few directions for each implementation category. In sales enablement, a less prevalent but high value use case is objection handling. While this is critical sales need, only 19% of respondents said they’re using AI for this now, so it could be a competitive advantage for those who exploit the gap. For example, by applying research and call intelligence to identify why buyers stall or say no, ABM-ers could help sellers speed up sales cycles and increase conversion rates, not just improve productivity. One respondent described how it could work: “I’ve programmed one of them to be an angry CIO. And I said, ‘as an angry CIO, you receive this invitation, rate it from one to 10, how could we improve, what would make it more appealing to you?’”

Another opportunity is ROI measurement and overall reporting. While just over one-third who deploy AI for analytics and insight are using it for ROI measurement, and just 6% for anomaly detection, those who do see clear benefits. As one ABM-er explained, “We’re learning in days what used to take months to measure.” Another noted, “Rather than spending hours looking through the Power BI reports, I can pretty much ask for the headlines on what’s happening.” Both use cases help teams understand more about performance so they ask the right questions and solve the right problems.

Why are many companies taking a cautious approach to AI implementation?

With so many potential benefits embedded in various ABM workflows, why aren’t we seeing faster adoption and more aggressive use cases? The answer seems to be right in the name of the technology, artificial intelligence. While the transformative potential of AI is in its infancy, it’s not seen as ready for autonomous delivery yet. (For more on this, read the first post in this series from Dorothea Gosling).

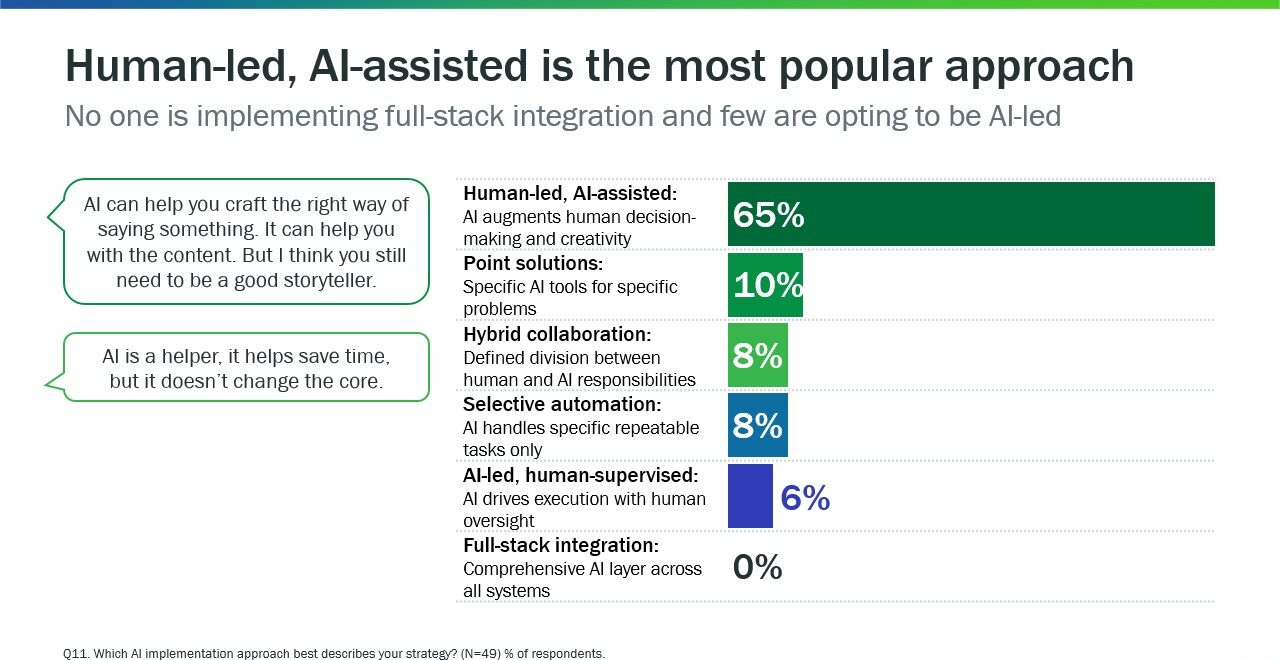

We asked survey respondents which AI implementation approach best describes their strategy, and 65% said “human-led, AI-assisted.” Inflexion Group defines this as where AI augments human decision-making and creativity. As we’re both getting used to AI and improving its abilities and training resources, having a human in the loop is essential to maintaining quality and creativity.

Current implementation strategies for AI in ABM

Source: 2025 Inflexion Group AI in ABM Benchmark Study

One respondent explained, “AI can help you craft the right way of saying something. It can help you with the content. But I think you still need to be a good storyteller.” Another said, “The skill to spot hallucinations is indispensable.” Only six percent of companies said their implementation strategy is “AI-led, human supervised.”

Also of note is the fact that no respondents said they have completed full-stack integration, described as a comprehensive AI layer across all systems. A variety of selective or point solutions are preferred by 26% of respondents. As one respondent said, “AI is a helper, it helps save time, but it doesn’t change the core.” Or at least not yet.

What AI platforms are companies choosing (and why)?

If companies are looking at human-led, AI-assisted point solutions, what technology or service providers are they working with today? Our fifth “why” looks at the variety of platforms, most of them familiar, that our data shows companies are deploying. We looked at six categories of AI platforms. Here they are in order of use within our respondent base. We allowed multiple responses to reflect the breadth of options.

- 74% use general AI platforms (e.g. ChatGPT, Google AI tools like Gemini and Bard, Microsoft Copilot, customer internal AI platforms, and others)

- 59% use meeting and communications AI platforms (e.g., AI features in Teams or Zoom, Otter.ai, Gong, Chorus, others)

- 56% use CRM or sales platform AI (e.g. Salesforce, Hubspot, Microsoft Dynamics, others)

- 50% use ABM platform AI features (6Sense, Marketo, Demandbase, Terminus, Pardot, others)

- 47% use analytics and BI AI tools (e.g., PowerBI, Tableau, others)

- 41% use AI content creation tools (e.g. Jasper, Copy.ai, Adobe AI, Writer, others)

While each of these categories has solid adoption in general, that’s where most concentration stops. Our data showed that within each category, little standardization exists. Companies have many options and are testing which ones work for them.

The biggest winners so far? Our study suggests it is technology incumbents. For example, in the general AI platforms category, ChatGPT is the choice of 57% of respondents using this category. This is impressive for a relative newcomer, but not surprising given its strong market awareness and presence. What might be surprising is that just behind is Microsoft Copilot, with 55% choosing to implement it. Salesforce AI is deployed by 68% of respondents who are working with the CRM/Sales platform AI category, followed by Hubspot at 24%. Our data suggests that well-known existing providers have the early advantage: the option of “other,” meant to capture newer entrants, hovers at between 11% and 26% for every category.

AI platforms in use by ABM teams

Source: 2025 Inflexion Group AI in ABM Benchmark Study

Why is this? A likely answer is ease of deployment, budget and time. Incumbent technology providers are investing in significant AI add-ons and actively promoting those to customers, often at relatively low prices. This making it more difficult to justify investing in a new offering. It’s also faster to approve a contract with an existing vendor who has already passed security requirements, especially critical in large enterprises.

That doesn’t mean experimentation isn’t happening, and our data also shows that new platforms are making fast progress. In the two platform categories that have been generally available the longest, general AI platforms and content creation tools, “other” was chosen by approximately a quarter of respondents, and ChatGPT has clearly made fast inroads. As companies gain experience with new tools and these options demonstrate better capabilities and features like outcome- and usage-based pricing that incumbents may not have, we’re likely to see new players garner a larger share of ABM budgets.

When will we see more substantial transformation from AI implementation in ABM?

Five whys may not be quite enough to unpack the variety of AI in ABM implementations, so we’ll close with a “when” question. Our benchmark shows companies are using ABM to solve for known challenges. The next question is when will they shift to deploying AI in a more transformative or disruptive way?

Athlete (and philosopher) Shaquille O’Neal said, “I never worry about the problem. I worry about the solution.” In the case of AI in ABM, transformation will happen when we start to look past solving known problems to disruptive solutions. As buyers demand better than “AI slop” and companies exhaust the competitive advantage to be gained from faster execution of established processes, AI will mature to provide solutions to new problems. In so doing, it will also create new opportunities and new winners.

As one respondent said, “Don’t try to shoehorn AI tools into existing processes – relook at your processes starting with AI tools – it will bring faster, quicker ROI.” And another noted, “Try, and fail, then try again. It’s new to us all and it’s a constantly evolving educational journey.”

What’s next in the series

In the coming weeks, my colleague Dorothea Gosling and I will continue to unpack the study findings in detail. Next week, Dorothea will share her insights about what companies are doing to address the challenges to implementing AI in ABM. Also don’t miss the first and second posts in the series:

Post 1 where Dorothea summarizes the study findings and shares highlights from her presentation and workshop on AI at the recent Global ABM conference (link in comments).

Post 2 where I share insights from the research on the foundations of AI in ABM adoption, including why companies are choosing to deploy AI, and how it’s changing their roles and teams.

About the 2025 AI in ABM Benchmarking Study

The 2025 Inflexion Group AI in ABM benchmarking study looks at how ABM professionals are integrating artificial intelligence (traditional, generative and agentic) into their daily workflows, and whether those efforts are creating measurable business value. It included two phases of research. The first was 20 in-depth interviews with global ABM programme leaders during August and September 2025. The second was a quantitative study in partnership with B2B Marketing where we invited ABM-ers to complete an online survey during September and October. A total of 66 people participated. Just over 50% of respondents were from global, enterprise-level companies with more than 5,000 employees and the rest were from companies ranging from those with fewer than 200 employees (23%) and from 201 to 1,001 employees (26%).